Trump Tariffs Create A Drag On GDP In Q4 2024

By drastically decreasing the trade balance, net exports and inventory drawdowns subtracted more than 1 percentage point from the last quarter’s economic performance

TLDR:

On January 29 (the day before the BEA's official GDP release), Atlas Analytics revised our GDP forecast to 2.8% due to the dramatically low international trade released that morning, which was 25% below its 12-month average.

As we noted in the post linked above, our core domestic production number based upon the satellite imagery did not change from our initial estimate of 3.5%.

Instead, we revised the net exports component down from -0.1pp to -0.7pp, which changed the ultimate GDP forecast to 2.8%.

This was all due to businesses' anticipation of Trump tariffs, which led to a dramatic drawdown in inventories and a scramble to import international supplies before tariffs altered their supply chains.

We are living in unprecedented economic times.

The Trump administration has kicked off trade wars not only with our adversaries (China) but also with some of our closest allies (Mexico and Canada). The result, as I wrote in our revised GDP forecast from January, was a dramatic increase in the importation of foreign goods ahead of Trump’s expected imposition of price hikes through tariffs.

In short, to prevent higher input costs, a vast swath of American companies “stocked up” on supplies by simultaneously increasing imports and drawing down their inventories.

The result was that the change in private inventories and the trade balance in Q4 2024 was far more negative than expected, leading to a deeply negative net exports and translating into a large drag on GDP of about ~1 percentage point (pp).

Here's some more detailed information:

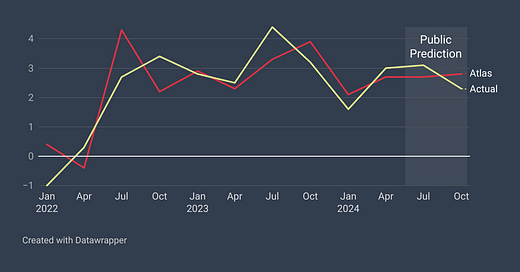

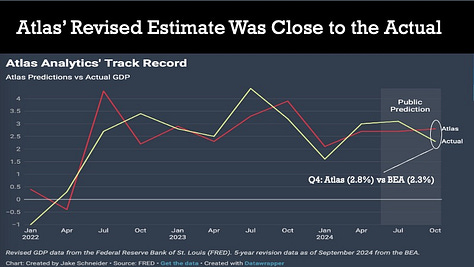

Atlas Analytics’ Revised Estimate Was Close To The Actual: If you accept Atlas Analytics' 2.8% number as our final forecast (it was submitted the day before GDP was released), then our prediction was within the 0.6pp standard error we expect based upon our past performance compared to the first estimate from the Bureau of Economic Analysis (BEA) of 2.3%. Overall, our track record of past performance is strong.

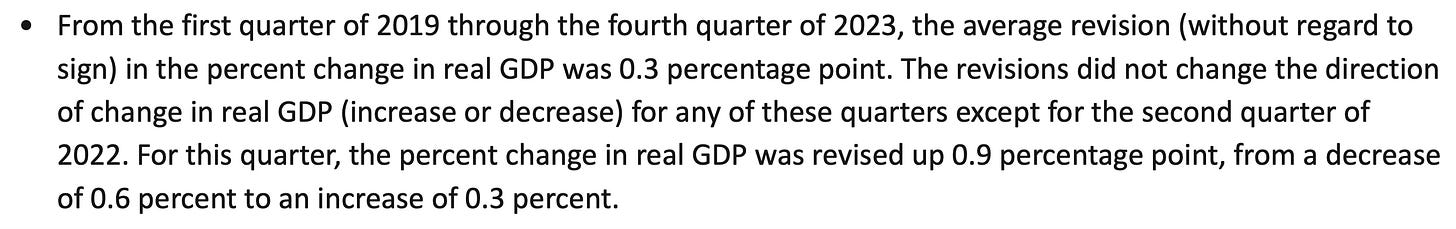

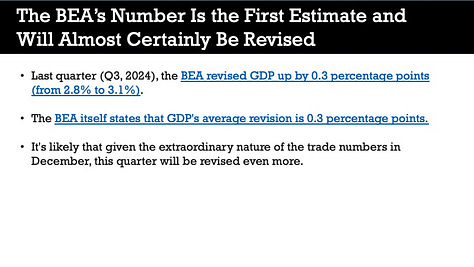

The BEA's Number Is the First Estimate and Almost Certainly Will Be Revised: Last quarter, the BEA revised GDP up by 0.3 percentage points (from 2.8% to 3.1%). The BEA itself states that GDP's average revision is 0.3 percentage points, and, given the extraordinary nature of the trade and inventories numbers in December, this quarter will be revised by even more.

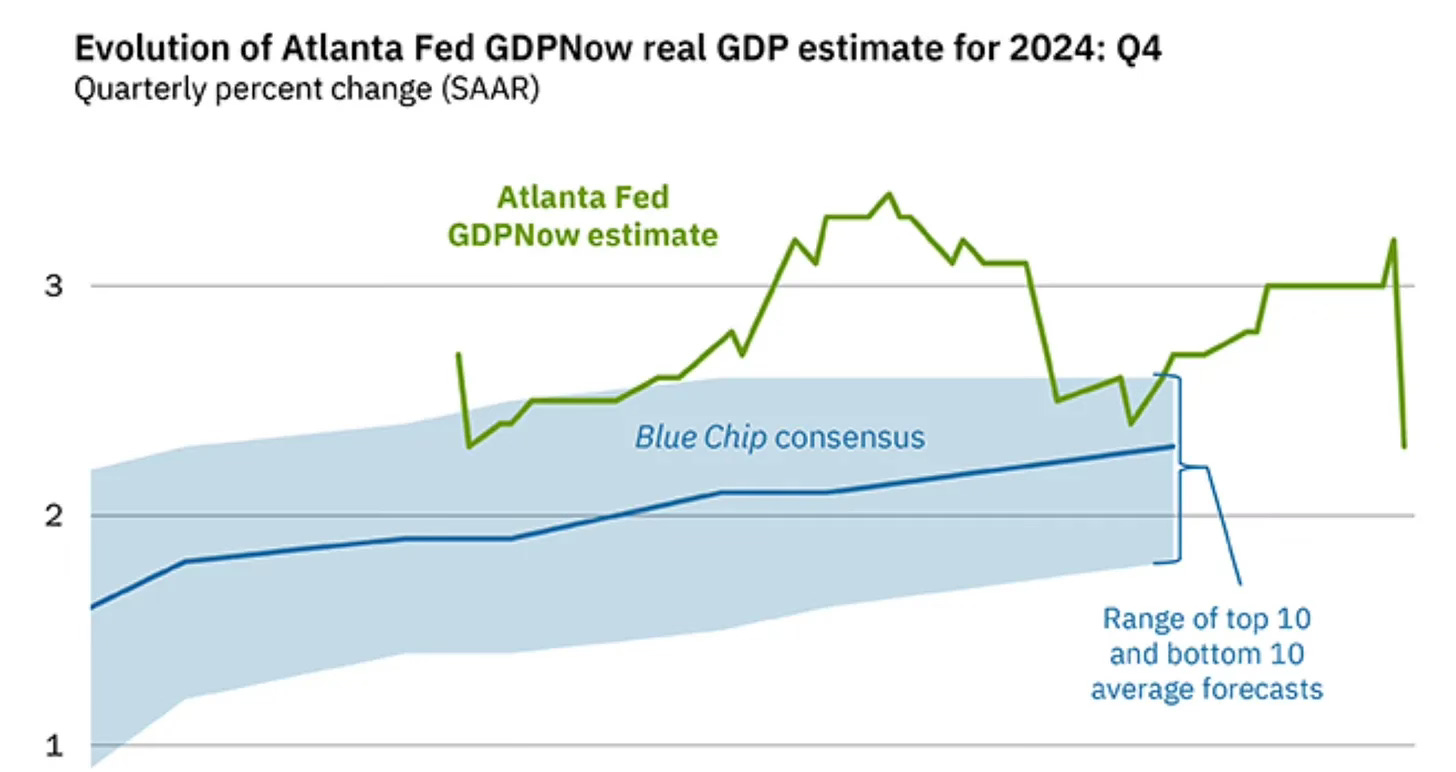

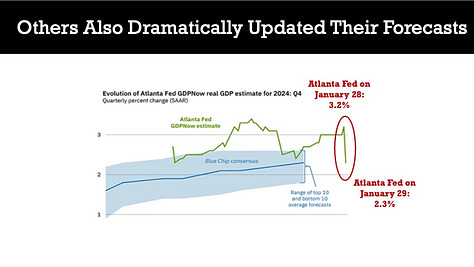

Others Dramatically Updated Their Forecast As Well: Atlas Analytics wasn’t the only one to adjust our forecast dramatically the day before GDP was released; in fact, the Atlanta Fed's GDPNow tool changed its forecast from 3.2% to 2.3% on January 29. Wondering how their forecast changed to the exactly correct number both this quarter and last, just a day ahead of GDP's release? It’s our suspicion they receive an embargoed copy of GDP about ~2 days before it's released.

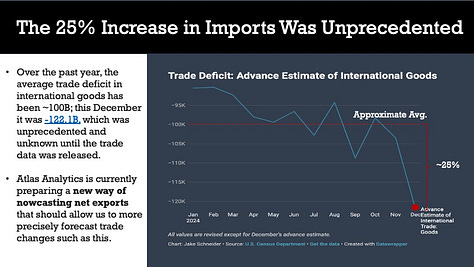

The 25% Increase in Imports Was Unprecedented: Over the past year, the average trade deficit in international goods has been ~100B; this December, it was -122.1B, which was unprecedented and unknown until the trade data was released. Atlas Analytics is currently preparing a new way of nowcasting net exports that should allow us to more precisely forecast trade changes such as this.

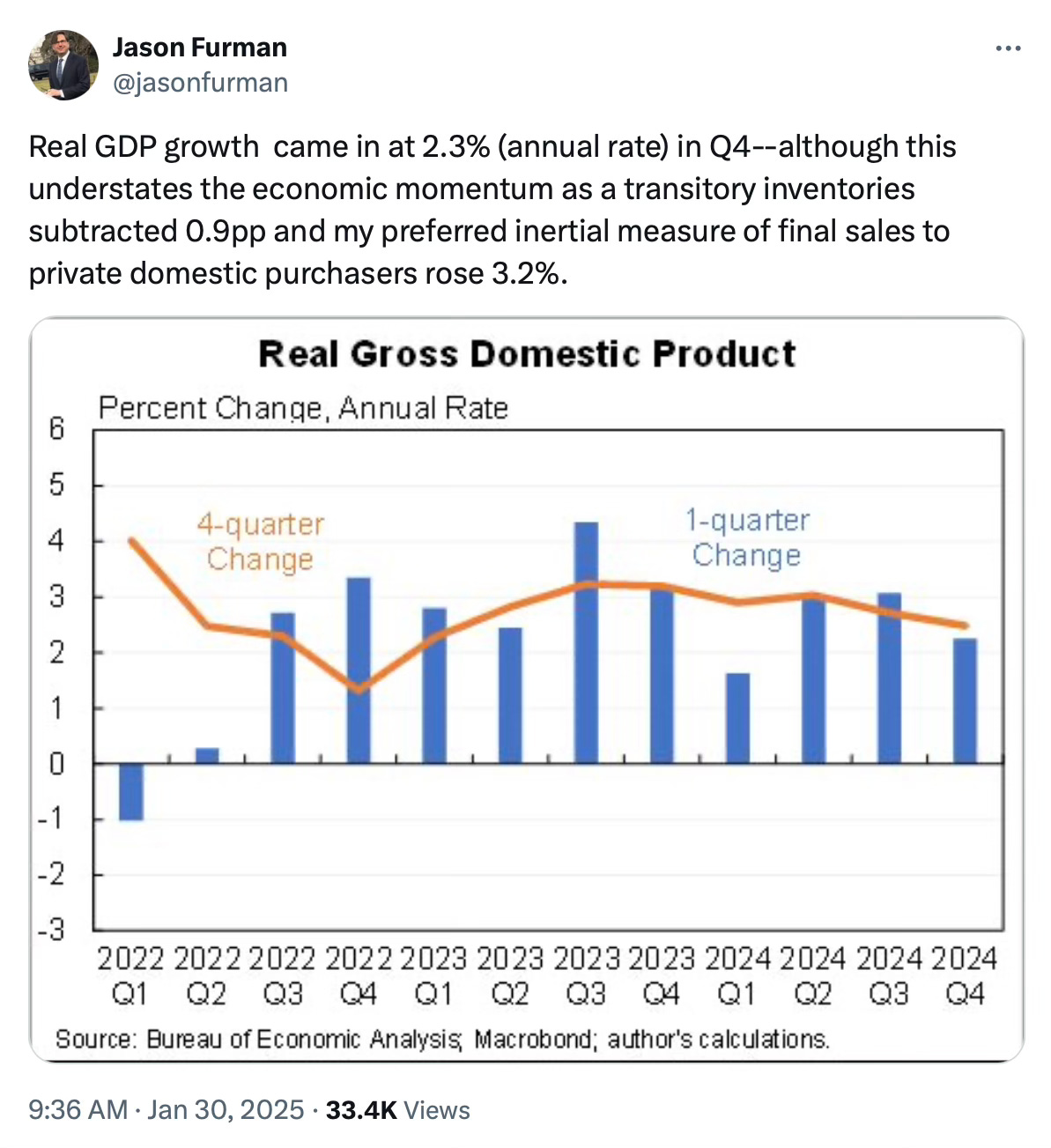

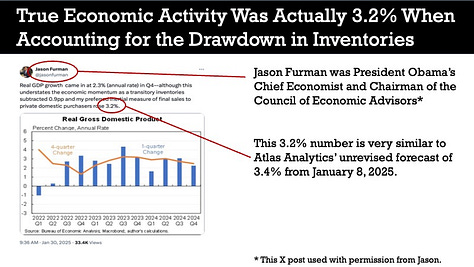

True Economic Activity Was Actually 3.2% When Accounting for the Drawdown in Inventories: According to the former Council of Economic Advisors Chair Jason Furman on X, final sales to private domestic purchasers was 3.2%, similar to Atlas Analytics' unrevised number of 3.4% (post included here with Jason’s permission).

Our most recent prediction for Q4 was a revised 2.8% versus the 2.3% first estimate from the BEA. In the future, our accuracy will only improve as we build subsequent algorithms to anticipate changes in inventories and net exports as they happen.

For more information on this quarter’s update, view our deck below:

For deeper insights into how to navigate these complicated market dynamics, contact Jake Schneider to discuss how Atlas Analytics can fine tune your investment strategy. For exclusive access to our latest GDP forecasts, subscribe to Premium today.

Visit us at our new site: https://atlasanalytics.com/.

P.S. Good luck in the Super Bowl tonight Kansas City Chiefs. Atlas Analytics is predicting the first-ever 3-peat (but we’re not putting much stock in it).