Dear Friends of Atlas Analytics,

The Magnificent 7 Bubble has burst.

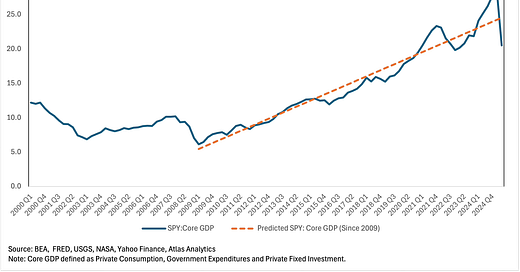

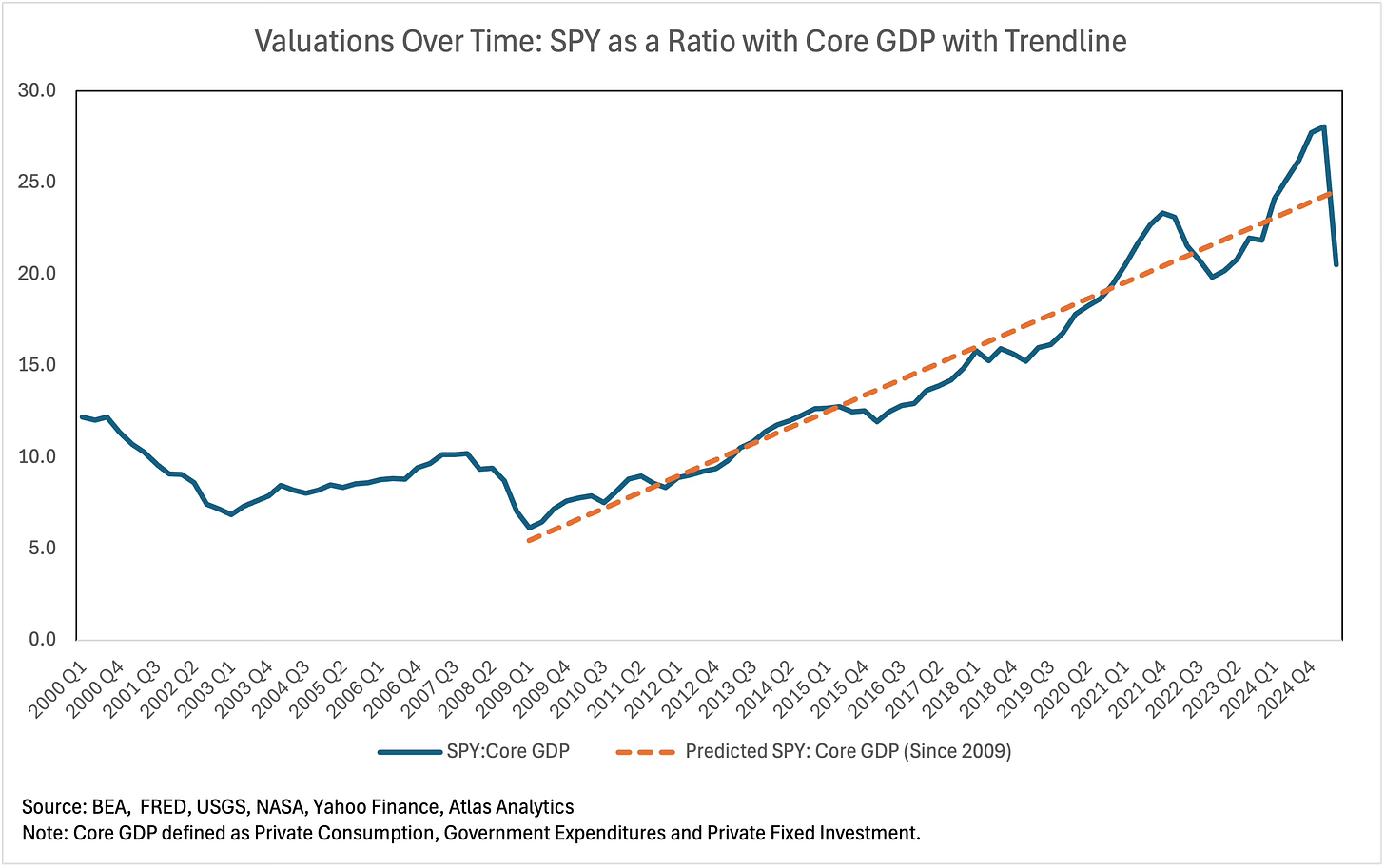

In last week's Substack article on the "Rubber Band" Theory of Finance, I introduced the idea of a P/E ratio not for equities but for the economy writ large. As a gentle reminder, this P/E ratio relates the earnings ("E") of the economy (i.e. GDP) to the price ("P)" of the broad market indices (i.e. the S&P 500, NASDAQ, or Dow Jones Industrial Average).

If you then calculate this ratio as the SPY (the ETF that tracks the S&P 500) divided by Core GDP (the measure of economic activity I coined by subtracting out volatile Net Exports and Inventories), you can track how the market values the broad indices over time. This ratio is charted below with one addition: the linear regression line of the Core GDP P/E ratio since 2009.

Keep reading with a 7-day free trial

Subscribe to Atlas Analytics to keep reading this post and get 7 days of free access to the full post archives.