Revision to Q4 GDP Forecast: 2.8%

Based on newly released and dramatically lower trade data, GDP will be below the consensus estimate of 3% when it is announced by the BEA tomorrow

TLDR:

Today, the Advance Estimate for US International Trade in Goods was released at -122.1B, approximately 25% below its average value for the last year.

This dramatically changes the contribution of Net Exports to GDP, revising down our Atlas Analytics forecast by 0.6 percentage points from 3.4% (our prior estimate) to 2.8% (our new forecast).

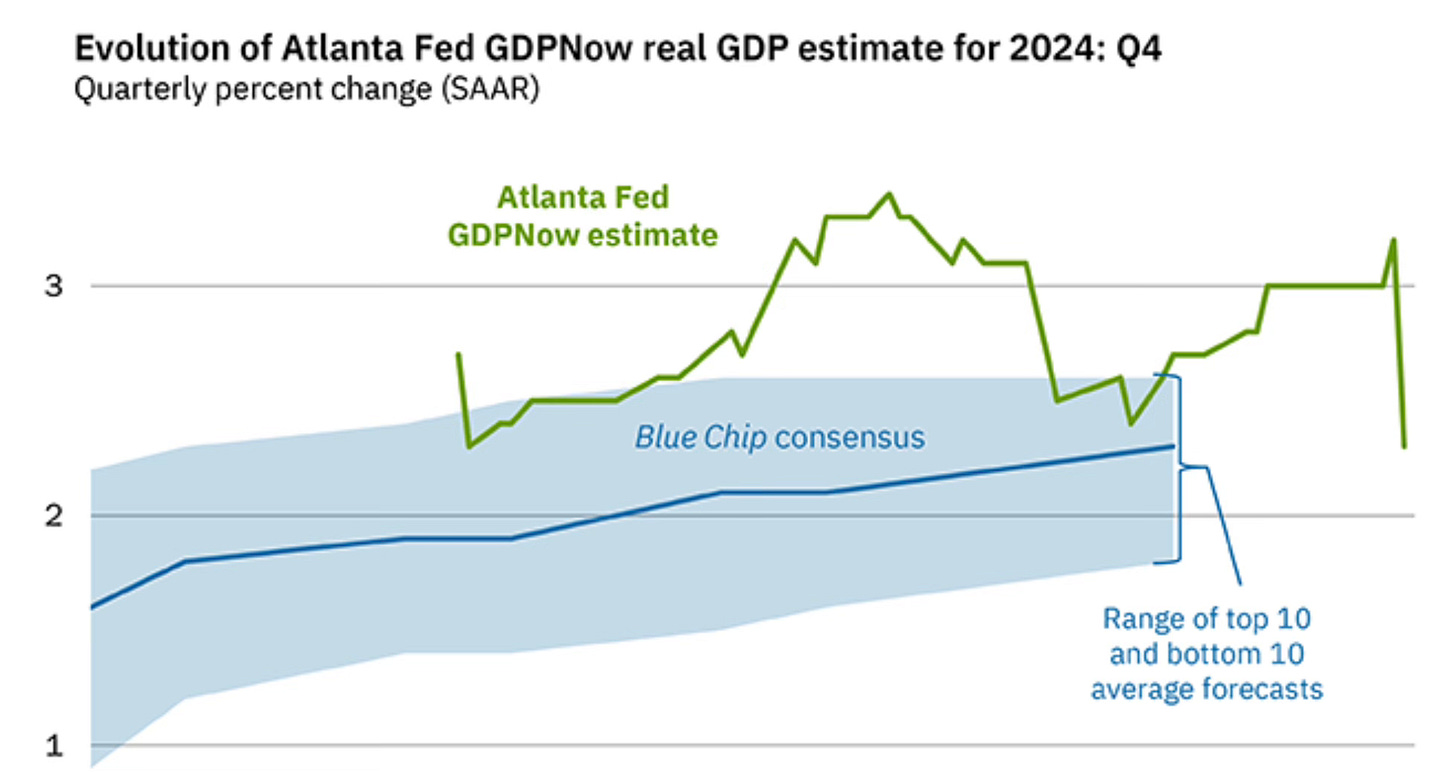

Other forecasters have made similar adjustments based upon this aberrant value, with the Atlanta Fed’s GDPNow Tool now predicting 2.3%.

This morning, the U.S. Census Bureau released a surprisingly weak Advance U.S. Trade in Goods statistic that fundamentally changed our forecast for this quarter’s GDP. Over the past 12 months, this statistic has varied from month-to-month by an average of only ~1.5%; however, this month’s number (for December) oscillated by 25% below its 12-month average.

To give more context on what happened, Atlas Analytics’ ROY currently has the Landsat satellites trained over the physical United States, allowing us to accurately and presciently forecast the three major components of the expenditure approach of GDP: Consumption, Investment, and Government spending. For the fourth and final component of GDP (Net Exports, which amounts to approximately ~10% of U.S. aggregate output), we use a regression model based upon the past three months of the trade balance. As the last month of the trade balance was announced today (and was extremely negative), we now take reason to adjust our forecast.

To be clear, the C + I + G (Consumption, Investment, and Government spending) forecast did not change, and we are still tracking a very strong domestic number at 3.5%. Instead, our prediction for Net Exports fell from approximately -0.1 percentage points to -0.7 percentage points.

Needless to say, Atlas Analytics (and the industry as a whole) were not expecting this and, as such, for the first time, we’re updating our GDP forecast to 2.8% SAAR prior to the official release from the Bureau of Economic Analysis tomorrow.

We’re not the only ones stunned by this census statistic and who are responding with an updated forecast. In fact, the Atlanta Fed dramatically altered their forecast from 3.2% yesterday to 2.3% today.

For this reason, Atlas Analytics believes that GDP will be below the consensus estimate of approximately ~3% but not by the magnitude that the Federal Reserve suggests.

In addition, Atlas Analytics is updating our annual forecast for 2024 from 2.7% to 2.5%.

You can expect these revisions will be infrequent for Atlas Analytics moving forward. Not only is our forecasting technology excellent for GDP, but we are actively improving our prediction algorithms for Net Exports to avoid this surprise again in the future.

What should you do in the meantime as an investor?

Consider Buying Tactical Puts: Prepare for a broader market pull back tomorrow and in the short term, but buying puts to protect your portfolio from downside risk.

Increase Your Exposure to Bonds: Given the Federal Reserve paused interest rates cuts (and may in fact raise the Federal Funds Rate going forward based on a careful reading of Jay Powell’s comments today), expanding your exposure to bonds might be a conservative way to gain value while protecting your overall portfolio.

Do Nothing: Many investors sell at the first sign of trouble and rejoice at the beginnings of an apparent bull market, but sometimes the most prudent advice is simply to wait and see what happens, adjusting course from there.

For more information, visit us at our new site here: https://atlasanalytics.com/.

For deeper insights into how to navigate these complicated market dynamics, contact Jake Schneider to discuss how Atlas Analytics can fine tune your investment strategy. For exclusive access to our latest GDP forecasts, subscribe to Premium today.