This week, Mr. Market came roaring back. From last Friday’s close (April 18, 2025) to this Friday’s close (April 25, 2025), the DIA rose 2.5%, the SPY rose 4.6%, and the QQQ rose 6.4%. My favorite ETF, the XLK, which I’ve written about extensively for its cheap expense ratio, soared a whopping 8.1%.

Did you buy the dip like I told you?

From my end, I continue to buy inexpensive call options (although, now they’re starting to become more expensive – more on this in a subsequent post) and offload my winners.

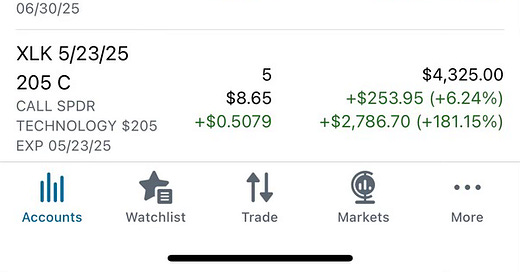

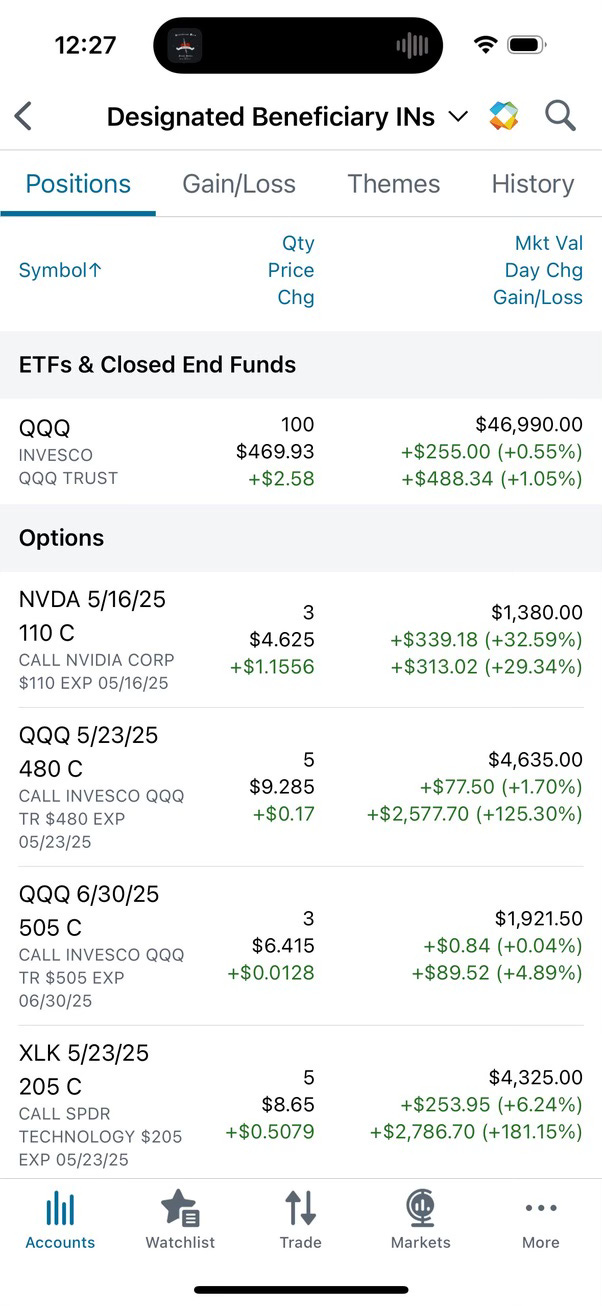

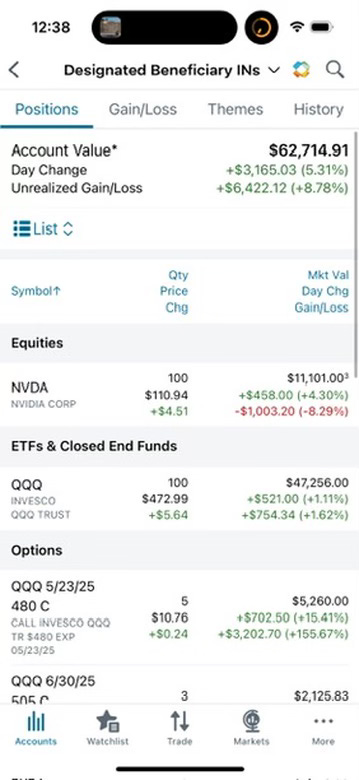

By selling my 3 long-call options on Nvidia (NVDA) just before close of business Friday, I earned 50% on this position alone. And, as I wrote two weeks ago, I continue to let my 480s on the QQQ and my 205s on the XLK ride (they still have a lot of extrinsic value as they expire in late May). (I also bought 3 long-calls on the QQQ at a strike price of 505 with a June 30 expiration.)

This brings my year to date (YTD) returns to nearly ~9%. Not bad considering the average weighted professional hedge fund returns for 2025 YTD was -0.94% according to Aurum.

So what is my investing strategy?

Keep reading with a 7-day free trial

Subscribe to Atlas Analytics to keep reading this post and get 7 days of free access to the full post archives.