Atlas Analytics’ Q4 2024 GDP Forecast: 3.4%

Macroeconomic forecasting is still in the dark ages. Atlas Analytics could be its renaissance.

TLDR:

Atlas Analytics forecasts a 3.4% annualized GDP growth for Q4 2024 ahead of the official release by the Bureau of Economic Analysis (BEA) on January 30. For 2024, Atlas projects 2.7% growth, surpassing more conservative predictions from the Federal Reserve and JPMorgan. Unlike others, Atlas delivers timely, accurate forecasts months in advance, helping investors make better decisions. Our Q1 2025 estimates are already in, providing a competitive edge over the official data to be released later this summer.

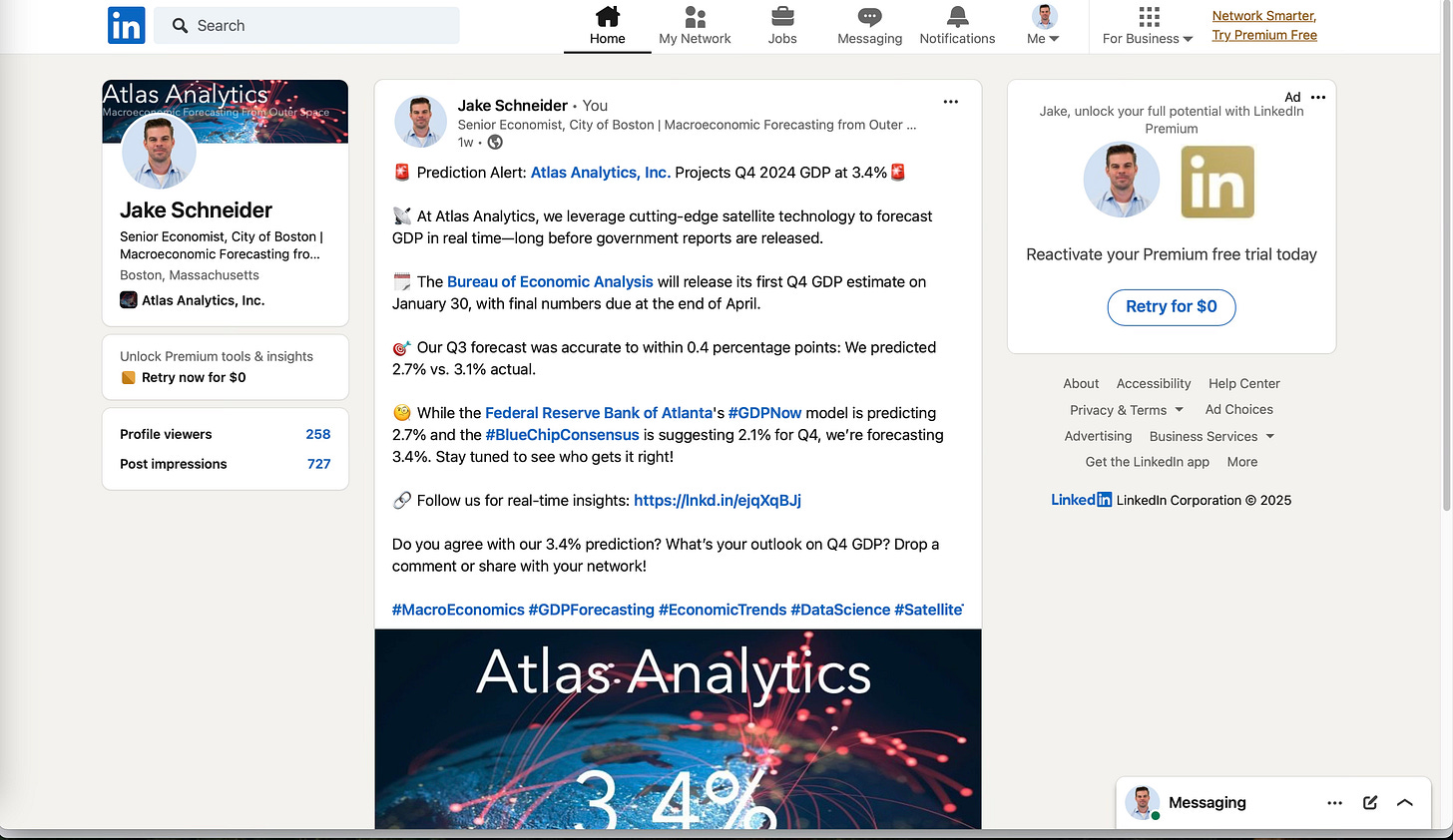

Atlas Analytics is forecasting big results for Quarter 4, 2024. As the video above states, on January 8, we predicted 3.4% annualized growth for the last quarter of last year (see the LinkedIn post below). On January 30, the Bureau of Economic Analysis (BEA) will announce the first estimate for this period’s GDP growth and the final number will be released on March 27. At that time, the BEA will release the final number for both the fourth quarter and the entirety of 2024.

For all of 2024, Atlas Analytics is projecting an annual growth rate of 2.7%. Compare this other forecasters:

Federal Reserve’s Summary of Economic Projections: Incredibly, as of their September forecast, they predicted 2.0% growth for every year between 2024 and 2027.

JPMorgan: On December 22, 2023, Anthony Chan, JPMorgan’s former chief economist, predicted 0.7% U.S. GDP growth for 2024.

Oxford Economics: Oxford Economics forecasted 2.7% GDP growth as of December 2024.

Clearly, macroeconomic forecasting is still in the dark ages. Our technology could be its renaissance.

Our technology is not only accurate but also timely, delivering data months in advance of official government releases so investors (and hopefully someday government policymakers themselves…) can make better capital allocation and policy implementation decisions.

Consider the fact that we made our 4Q prediction three weeks ahead of the BEA’s release and a full three months ahead of the final. Is there actually that much of a difference between first release and final estimate? Last quarter, the BEA first released the number at 2.8% before revising it to 3.1%, a change of 300 basis points.

Even more critically, Atlas Analytics already has estimates for Quarter 1 2025 data. That number won’t be first released by the BEA until April 30 with the final coming in June. In contrast, Atlas Analytics knows where the economy is within the business cycle now whereas the rest of the world will not have this information until the summer.

This also means we have appropriate price targets for where you could be investing your money over that time frame.

Ready to start working with us and experience the decision-making power Atlas Analytics offers? Contact us today.