Atlas Analytics’ Q3 GDP Prediction: 2.7%

Economic Activity is Stronger than the Consensus Believes But Perhaps Not As Robust as the Atlanta Fed's GDPNow is Projecting

Source: Atlas Analytics

In the U.S., GDP is released quarterly from the Bureau of Economic Analysis (BEA). These figures are meant to indicate how the health of the U.S. economy is fairing. Yet these numbers are also revised twice after the initial estimate, meaning there’s at least a three-month lag between the end of a quarter and when we know how the economy actually performed during that period.

Using satellite imagery and collated traditional macroeconomic data, Atlas Analytics is able to generate a real-time estimate of economic activity ahead of the government releases. And this can help investors experience tangible results and, ultimately, make money.

The next GDP release is slated for October 30, 2024, and the final revision will be shared in late December. As of Friday, September 27, we predicted Q3 GDP will be around ~2.7% with a standard error of 0.7pp. All of this was achieved using Atlas Analytics.

Source: Atlas Analytics

It should be noted that we think this 2.7% number might actually be an under-estimate. Since we made this prediction in late September, the US Trade Balance in Goods and Services data was released on October 8, and it showed that the US trade deficit abated slightly in August. With this new estimate, Atlas Analytics has reason to believe that the Net Exports contribution to GDP will be less negative than previously thought. As such, we think the balance of evidence ways to the upside and the Q3 US GDP number will likely be closer to ~3.1%.

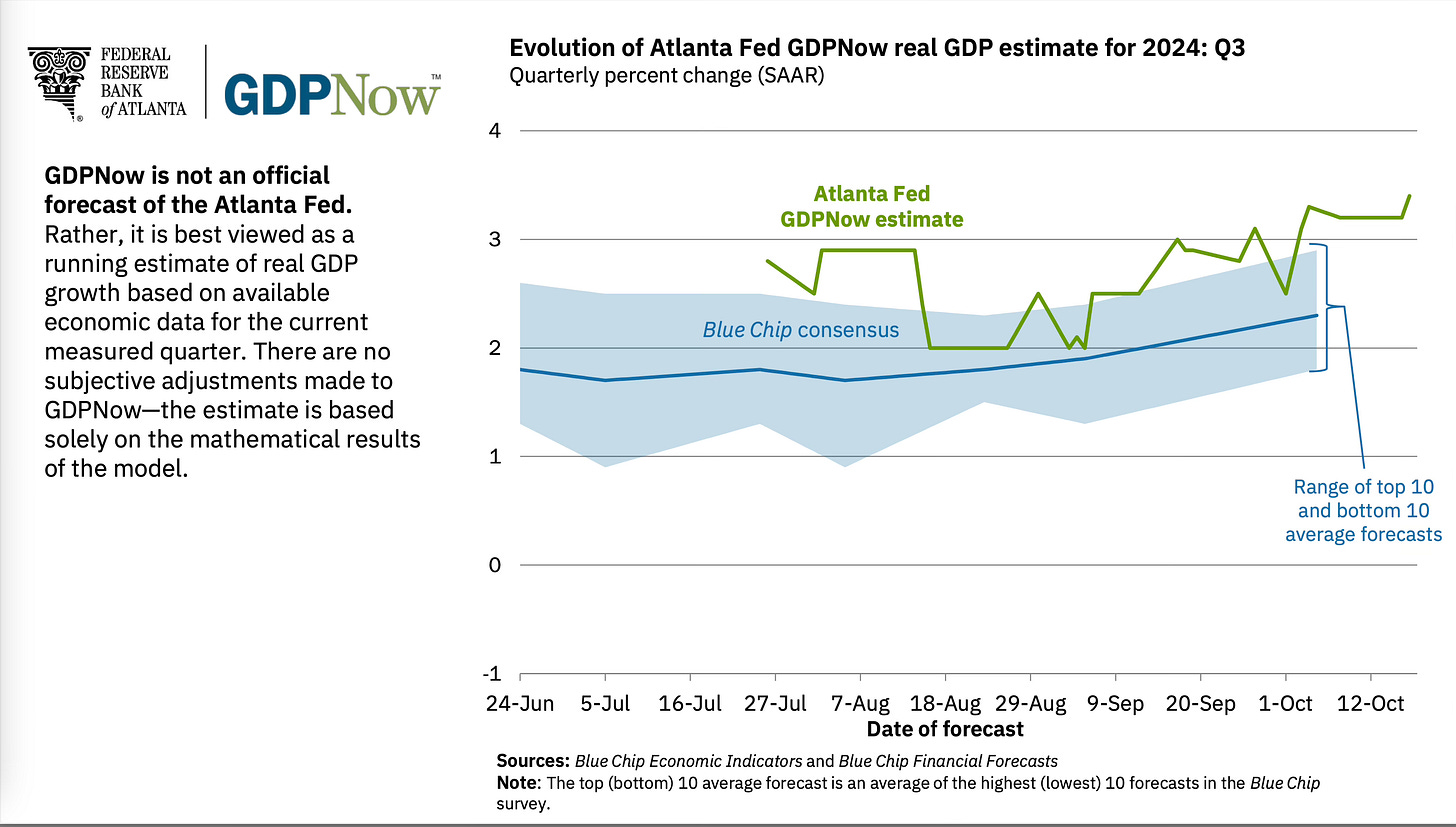

Compare this to the Atlanta Fed’s GDPNow, which predicted 2.5% as of October 5 and a robust 3.4% as of October 17, or compared to the Philadelphia Fed’s Survey of Professional Forecasters who predicted 1.9% as of August 9.

Source: Atlanta Fed GDPNow

With Atlas Analytics’ ROY as a guide, we believe the consensus is wrong. GDP is not as weak as industry pundits and Wall Street are saying, and the economic malaise narrative is just flat wrong. If we’re right, then investors should position themselves long on both equities and options in order to take advantage of the upside when GDP is released.

Some examples of this might be buying long calls or bull call spreads to take advantage of the upside surprise to GDP, or, if you’re not comfortable with derivatives, buying growth equities (as opposed to value).

Time will show if our projections are correct. Message, subscribe or connect to learn more and upgrade to view Atlas Analytics’ Q4 US GDP forecast on our Client Portal, which our team is already tracking.